Designers need to consider how the costs of materials, manufacturing processes, scale of production and labour contribute to the retail cost of a product. Strategies for minimizing these costs at the design stage are most effective to ensure that a product is affordable and can gain a financial return.

The economic viability of a product is paramount for designers if they are to get their product into production. Understanding how to design a product to specification, at lowest cost and to the appropriate quality while giving added value, can determine the relationship between what a product is worth and how much it costs.

Cost-effectiveness

- The most efficient way of designing and producing a product from the manufacturer’s point of view.

- Costs that the manufacture is likely to incur, such as, capital costs (machinery and factory), R&D, Marketing, energy, overheads, taxes, profits, storage etc

Value for money

- The relationship between what something, for example a product, is worth and the cash amount spent on it

- The consumer decides if it was well worth spending the money on something.

- It is an individual judgement and different people will value something differently.

Costing versus pricing:

- In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something.

- Pricing is the process of determining what a company will receive in exchange for its product or service. The potential profit.

- More examples include labour, manufacturing costs, costs relating to availability and procurement of materials, profits and taxes, size and weight of product for storage and distribution, resources, distribution and sales.

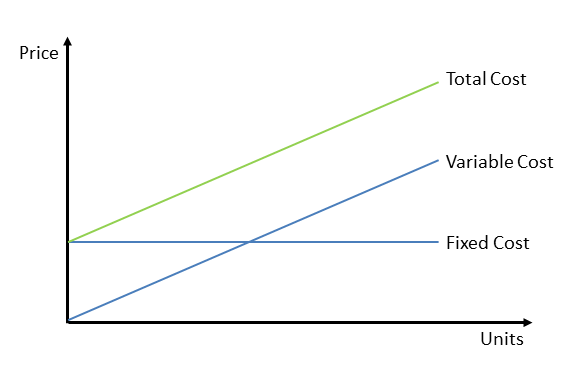

Fixed costs

- The costs that must be paid out before production starts, for example, machinery. These costs do not change with the level of production.

- Fixed costs, indirect costs or overheads are business expenses that are not dependent on the level of goods or services produced by the business, i.e., not reliant on output.

- More examples include, scale of production, complexity of product, skills, quality control, type of advertising and marketing, R&D, capital costs, overheads, labour (directly related to production output).

Variable costs

- Variable costs are costs that change in proportion to the goods or service that a business produces, i.e. reliant on output.

- These costs are incurred once production starts.

- These include, materials (processed and raw), utilities (electricity, water etc), wages, storage, distribution.

- Fixed costs and variable costs make up the two components of total cost.

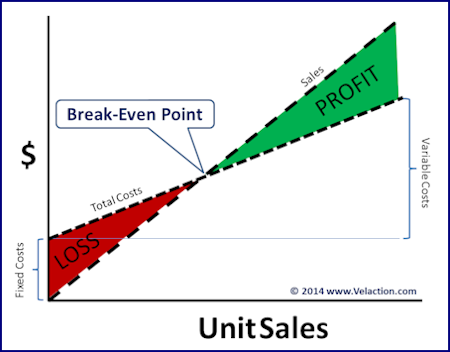

Cost analysis

- It is a tool used to determine the potential risks and gains of producing a product.

- It is used by manufacturers to determine the break-even point for a product and can be used to create multiple scenarios for a product.

- It allows the feasibility of a product to be established.

Break-even

- It is the point of balance between profit and loss. It represents the number of sales of a product required to cover the total costs (fixed and variable).

- The break-even level or break-even point (BEP) represents the sales amount—in either unit or revenue terms—that is required to cover total costs (both fixed and variable). Total profit at the break-even point is zero. Break-even is only possible if a firm’s prices are higher than its variable costs per unit.

Calculating Product Price

- Designers must consider encomium feasibility of their designs.

- When companies calculate the price of their products they use Pricing Strategies described below.

- Often more than one strategy would be used.

- The below strategies can be used in conjunction with the Price Setting Strategies listed in topic 9.3: Marketing mix.

- Price Setting Strategies include: cost-plus pricing, demand pricing, competitor-based pricing, product line pricing, psychological pricing.

Pricing strategies:

Price-minus

- The market demand determines the product pricing (selling price) before manufacturing begins.

- Then all commercial costs (manufacture, profits, etc) are determined and the company works within these constraints.

Retail price

- It is the recommended retail price (RRP) suggested by the manufacturer (MSRP) that the retailer should sell the product for.

- It is to standardise prices

- Some retailers will sell below the RRP to lure customers.

Wholesale price

- The cost of a product sold by the wholesaler.

- The product costs more than the manufacturer but less than the retailer.

Typical manufacturing price

- It is the total costs (variable and fixed) to manufacture the product. Divide the total manufacturing/product costs by the total products/items produced to get the average cost/price per unit.

- Once total costs are determined then a profit margin is added.

- The goal is to maximise profit.

Target cost

- It is desired final cost of a product is determined before manufacturing begins.

- This is based on the competing pricing.

- Profit is then removed to determine initial cost.

- The product is design or designed to meet it

- Wikipedia on target costing

Return on investment (ROI)

- Receiving a profit (return) on money invested into the product or service.

- Usually expressed as a percentage.

- The higher the ROI the better return

Unit cost

- The costs a company incurs to produce store and sell one product (item).

- This is calculated as an average cost.

- These include fixed and variable costs

Sales volume

- It is the amount of products sold in a specified time period during regular working operations of a company.

- They can be annual, quarterly, etc sales

- Can also be based on demographics, geographic regions, etc

Financial return

- It is the profits generated from a sale or investment into a company.

Activity: Calculation of prices based on the listed pricing strategies.

International Mindedness

The cost effectiveness of a product can determine whether it can enter economically diverse national and international markets.

Theory of Knowledge

The retail price of a product is partly based on evidence of its potential position in the market. What counts as evidence in various areas of knowledge?

Something Extra …

Work Cited: